I’m not talking about the banks or even the retailers. We all know they will continue to slide. I’m talking about everything else.

With no real median wage growth since 1999, and soaring inflation for gas, food and healthcare, it’s obvious consumers have had much less to spend. Not only has that hurt savings rates (including retirement contributions) but it’s also affected consumer spending. So don’t expect things to get better by Fall. In fact, I’m expecting the earnings meltdown to begin for much of the remaining sectors in the S&P 500.

You Can Run but You Can’t Hide

Standard & Poor’s earnings estimates for Q2, Q3, and Q4 of 2008 are -11%, 40%, and 60% respectively.

Remember, this the same S&P that rated the mortgage junk AAA. It will also be the same S&P that will end up issuing drastic revisions in earnings once the bottom falls out. But that won’t help investors after the fact.

You have to realize what lies ahead and react accordingly. With about 65% of the S&P 500 companies having reported Q2 earnings, the results have not been so bad, with about 70% having beat the 2007 mark. In fact, as the pundits love pointing out, “if you remove the problem child – the financials, S&P earnings have increased by 10%.”

"Regardless of the estimates or hype, a double-digit gain from non-financials is impressive — in any economy," said Howard Silverblatt, S&P's senior index analyst.

Sure it’s impressive when the Fed has been in a printing frenzy.

Well guess what? You can’t remove the financials from S&P earnings. With about 92 financials in this index of 500, we are talking about 16.7%. Also consider that earnings were aggressively revised downward so as not to disappoint.

More important, how well do you think earnings will be down the road with the heart of the economy – the financial system - collapsing?

Add to that soaring inflation and you will soon see earnings collapse as consumers fall flat on their face. Even the correction in oil prices won’t save the ship. Oil would have to fall to $80 or lower and stay low for many months. Even if it did, it would take 6 months to a year before the effects would be seen in the economy.

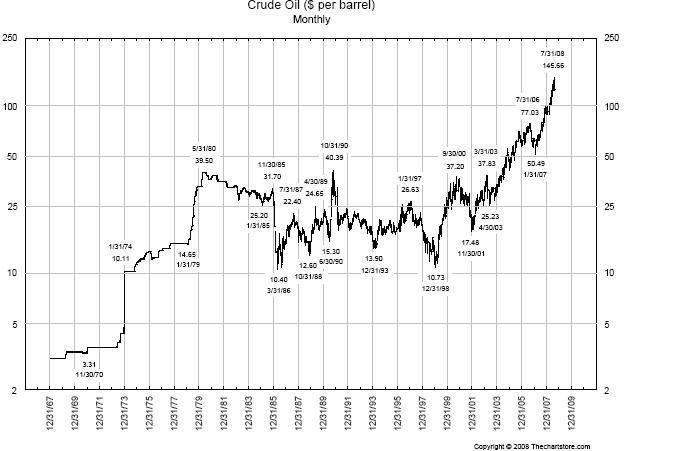

So how far will oil correct? Well as you may recall, in a previous article, I mentioned the possibility for a 30% to 40% correction in oil when it was around $140 (see “Using Oil to Beat Inflation”). Thus far, my forecasts have not changed except I am now leaning towards the high end of this estimate, placing the correction to around $100. At least in America’s case, that is really the one trillion dollar question.

Could oil correct down to $80? Yes. But I would not expect to stay there for long. Remember this is just a short-term trend. As you can see from the chart, the long term trend remains strongly intact. Therefore, this correction will present a buying opportunity in the near future. Consequently, it is due to these huge swings in volatility that I recommend non-active traders to consider investing in oil trusts since they deliver nice double-digit dividends.

Distance Yourself from the Herd

Please do not forget that Washington through its rebate checks, and the Fed through its endless printing of money, have made their most desperate attempts to delay a recession. While they have failed in my opinion, the real severity is coming soon.

Make no mistake about it; S&P earnings estimates for Q4 won’t even come close to estimates. By the time Washington reports the required (and laughable) “two consecutive quarters of negative GDP” it uses to officially acknowledge a recession, it will be too late for investors who followed this herd mentality.

Continued problems in the credit markets combined inflation will create a drag on earnings. This will accelerate corporate bankruptcies by late 2008, only to soar thereafter. Perhaps the only force that will help earnings will also be the force that ultimately takes them down - inflation. You can’t inflate your way out of a recession, nor can you consume your way out of one either. And Washington is about to learn this first hand.

Sure, it’s possible that we will see the market rally over the next couple of months. If so, you would be wise to sell. More aggressive traders might consider shorting it entirely once it tops out based on the 1-year resistance trend line.

It’s also possible that the Dow will break down below the 10,731 lows it made a couple of weeks ago. Only time will tell. It all depends on when the consumers fall and companies start to revise downward. Throughout this difficult period, you would be wise to keep in mind where the slope of the DJIA lies. Eventually, the Dow will follow this slope. It’s just that simple. Don’t try to make it more difficult than it really is.

.jpg)

Now that you know the other side of the picture, you should be better positioned to navigate the market through 2008. As I have been advising for several months, you should sell on rallies and only buy after sell-offs if you’re a really good trader because the market is trending downward.

The few investors who had the luck or insight to liquidate their portfolios many months ago might be better off waiting for more clarity. The correction in oil will most likely continue, but that will represent a buying opportunity. I will continue to buy more oil and healthcare. Everything else in the U.S. market is a lost cause for now.

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse.

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribesmen (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

Opening Statement from the January 2016 Intelligent Investor Originally published on January 6, 2016 As expected, Q3 earnings declined y-o-y, but the downturn was not as bad as previously es...

We have just released a very important audio originally provided to subscribers of the Intelligent Investor and Market Forecaster last summer, entitled, August 23, 2015 Economic and Market Overview an...

For those of you who might be wondering if Mike finally missed a market downturn, after having accurately nailed every single selloff and rally since March 2009. The answer is NO. Mike has been wa...

Please click the PDF icon below to download this document.

Opening Statement from the November 2015 Intelligent Investor Originally published on November 5, 2015 (pre-market) The US stock market has recovered from its largest selloff in four years,...

Opening Statement from the October 2015 Intelligent Investor Originally published on October 7, 2015 Review of the Past 12 Months First, let’s summarize our assessment and guidance from...

Opening Statement from the December 2014 Intelligent Investor (Part 3) First published on December 9, 2014 for subscribers to the Intelligent Investor Over the past couple of months we have bee...

For the 15th consecutive quarter, dividends per share (DPS) for the S&P 500 has grown at double-digit rates.

Can anyone offer any evidence that there is someone who is any better than Mike? If so, you would have already landed our $100,000 prize. The fact is that no can because...

Mike Stathis is simply the best. If you aren't aware of that, then you just don't know his track record. Perhaps you're spending too much time listening to charlatans.

Originally published on July 13, 2014. Once again, Mike Stathis nailed the most recent market sell off in April, having warned readers that the Dow Jones would almost definitely sell......

Opening Statement from May 2014 Intelligent Investor (Part 3) First published on May 7, 2014 for subscribers to the Intelligent Investor Moving past this period, we feel there is a good chanc...

Originally Published on April 17, 2014 from the Opening Statement of the April 2014 issue of Dividend Gems The harsh winter season has put a dent in the earnings of some retailers. But the bi...

Opening Statement from April 2014 Intelligent Investor (Part 3) First published on April 4, 2014 for subscribers to the Intelligent Investor In the Market Forecasting section (Part 2...

Originally Published on March 16, 2014 from the Opening Statement of the March 2014 issue of Dividend Gems Last month we discussed that the US stock market continued to rise almost irrespecti...

Originally Published on March 5, 2014 in Part 3 of the March 2014 Intelligent Investor Although we successfully navigated the most recent correction in the US stock market, we are faced with...

The release of this video is part of a new series we have recently launched for the purpose of helping the public become more familiar with the track record and insights of Mike Stathis. Those who a...

We will be making more of these videos in the future so the newer guests of the website can see that no one can come close to the track record of Mike Stathis. We hope to make 20 or more videos in 201...

In August 2009, Mike Stathis posted a reward for the first person who could prove that there was a financial professional that could match his track record before, during and after the economic collap...

Today, WellPoint (WLP) announced a $4.46 billion buyout offer for Amerigroup (AGP), causing shares to soar by 38%. Since being added to our recommended list just over two years ago, shares of AGP have...

We have received several inquiries recently from investors wondering whether it’s “too late” to purchase the video series we have been highlighting because they have seen how we nailed so many of thes...

Here, we provide readers with a glimpse of our market forecasts between February and April 2012 demonstrating once again that we are the best market forecasters in the world. As many of you recall,...

Originally Published on March 13, 2012, Dividend Gems Opening Statement In late January the Federal Reserve Bank announced that it intended to keep short-term interest rates at current...

Last week, we showed how the Dividend Gems Recommended Securities List was holding up through the current market correction, from the time the May issue was released, through June 2. The performance o...

The winners keep on rolling in. The chart below shows the past 12 months of a stock I have loved for several years. Like many of my past small and mid cap growth stories, this one was un......

On April 5 before the U.S. market opened, we released the monthly issue of the Intelligent Investor; about 70 pages discussing everything from domestic and global economics, to currency, gold, silver,...

What is you knew when to sell the stock market in May and when to buy it back? If you knew this information, you wouldn't even need to know a thing about securities. All you would need to do is sell w...

Over the past several months we have been publishing the spectacualr outperformance of the securities in the Dividend Gems Recommended List. Here, we show the performance of each of th......

How much more will the stock market decline? Should you sell? When should you buy?

While the 10-year U.S. Treasury Note continues to languish in a sea of global uncertainty, all while short-term interest rates remain at dangerously record-low levels, more than 200 U.S. listed securi......

Approximately three months weeks ago the U.S. markets began to correct. We warned about this first correction in the May issue of our firms paid research publications.

On Friday, Amerigroup (AGP) reported disappointing earnings partly due to an account error. However, after adjusting for this issue, earnings still came in considerably lower than consensus. The...

I'll be short about this because I have better things to do than devote my time to useless companies who boast a basic website as their main asset. For several years now, LinkedIn has blatantly v...

As the market has sold off over the past month, the Dividend Gems Recommended List has once again outperformed. Below are charts representing EVERY security in the Dividend Gems Recommended List so yo...

The market has been boosted recently by strong earnings from INTC and others. This latest round of earnings has largely dampened any negative sentiment that may have been rising due to so-so earnings,......

We wanted to take this opportunity to remind you about our newest investment newsletter, Dividend Gems.

Just some quick thoughts, nothing set in stone here. Earnings are starting to come in a bit "ify;" not so great, but not bad. Expectations are key. Starting to see a few m...

Wednesday, March 2nd: US (Fed’s Beige Book, MBA Mortgage Applications, Challenger Job Cuts, ADP Employment Change); EuroZone (Euro-Zone PPI); Latin America (Brazil rate decision). Thursd......

In the November 2010 issue of the Intelligent Investor newsletter, our Chief Investment and Trading Strategist, Mike Stathis added Atheros Communications (ATHR) to his recommended list. At......

(website issues are being addressed) Funds Flow Out of EM Equities and Into Bonds Emerging market (EM) assets showed mutual fund outflows of $1.4 billion in the week to 23 February 2011, with inflow......

As many of you know, we just launched the first issue of our newest investment newsletter in February called Dividend Gems. Given the recent correction in the market, we wanted to show the perf......

We will be releasing a commentary written by our Chief Investment Strategist, Mike Stathis some time this evening for subscribers of the Intelligent Investor and Market Forecaster newsletters. Mike......

Mike has added 2 new stocks to his recommendations contained in the Intelligent Investor, one soft line retailer and the other from high-tech. Subscribers who did not receive this brief report, pleas......

A couple of days ago I showed you how a stock I had been in and out of for over a year had performed since recommending another entry point in the January 2011 newsletter.

Just a note to those who haven't signed up yet for the newsletter. In just three days since the newsletter was released, one of Mike's most highly recommended stocks soared by more than 25%. Hav......

I'll be brief here. If you retrace the events over the past two years and you are familiar with the market activity, you will come across one recurring trend; the timeliness of bailouts and other meas...

Buy you ask? Yes. Not stocks, unless you’re talking about oil. And unless you’re the best of the best of traders you’ll probably want to buy the oil trusts, but only if you b...

I want to warn those of you who have accounts with Charles Schwab to close your accounts immediately. The situation involves errors in order entry for which Schwab refuses to acknowledge or correct.

Early last month, the Commerce Department released the latest GDP data. For Q2 of 2010 the GDP growth came in at 2.4%, missing the consensus estimate of 2.5%. The Commerce Department also released it...

Effective immediately, and for a limited time only, we are offering readers a transcript of a recent interview given by Mike Stathis, the Chief Investment and Trading Strategist of...

Today, the criminal PR arm of Wall Street, CNBC, interviewed Alan Greenspan hoping to draw a big audience of sheep using the "big name" tactic. Forget Greenspan is the single person most r...

I hate repeating myself over and over. Who doesn't right? Well, it's especially cumbersome to repeat oneself when the only form of communication you have is writing (albeit with extr...

I'll be concise here. The White House's recent 6-month ban on deep water drilling could send ripples throughout the industry, specifically for oil exploration firms that have a large amount of ul...

I've added this question to the website poll to the left, so I want to encourage you to take a stab. Before you place your vote, I will go ahead and tell you the answer is NOT Greece. So y...

I wanted to give you an overview of what I see today and explain how you should view things, emphasizing the need to understand your own investment strategy, because I know that those who read th...

As subscribers to the AVAIA newsletter know, the special report released on May 9 was quite accurate. In short, anyone who had access to the special report could have avoided up to an ...

A couple of weeks ago, I released a report discussing how I was able to get in on Merck for big gains, while virtually everyone else left the company for dead after the Vioxx scandal played out. /arti...

In the past, I have addressed the errors made by Peter Schiff's analysis of the economy and healthcare. For those of you who are still behind the curve and actually think Schiff...

Subscribers to the AVA Investment Analytics newsletter will be receiving a special report that discusses forward direction of the market, as well as analysis of selected securities. Thi...

In the Wall Street Investment Bible, I discussed other securities I that had a good chance of bankruptcy down the road (e.g. Blockbuster and Sirius Satellite). Regardless what ultimately happens...

Rather than a sigh of relief, Greece's bailout signals more to come from Eastern Europe. And rather than a more peaceful Greece, it the EU-IMF bailout is likely to result in major riots and...

Okay folks. I've been working on the May newsletter over the past few days and one of the securities submitted for analysis was Monsanto. I've actually meant to do some write-ups on the controversial...

I don't want to waste anymore time on this than I have to. Let me just say that the SEC's latest bogus attempt to prevent another securitized asset blow up is a complete joke. The SEC ...

Before I begin, I would like to say that most of you will need to actually study this article. You will need to read it and reread it. You will need to look at your own charts of the Dow.....

Here's an article discussing the fact that JP Morgan and Citigroup escalated the collapse of Lehman Brothers by increasing the collateral and altering terms and conditions for lending.

The past six trading days has not been kind to the market, despite some rather good earnings reports from AMD, GOOG, and many other companies one might expect to not be faring so well. However, one of...

This is just a reminder to those who don't know about me.

A couple of weeks ago, I wrote a piece discussing allegations of insider trading and illegal naked short selling of Washington Mutual, involving the banking cartel and potentially their hedge fund cli...

For years, investors boasted what a great company General Electric was. Even CEOs marveled at the company's ability to consistently deliver strong earnings growth despite its massive size....

This September 25th 2009 marked the one-year anniversary of Washington Mutual’s seizure, by the Office of Thrift Supervision (supposedly) as a result of insolvency (supposedly). Last year, on O...

Hopefully, you have read my recently released SEC complaint alleging insider trading and illegal naked short sales involving the banking cartel, as well as criminal involvement of former SEC ...

My advice is to find some people who you trust; those with proven track records, those who are not tied to the television shows. Figure it out. You are only going to be misled by the mainstream med...

It’s extraordinarily rare to find a book that provides specific securities analysis, enabling investors to profit based upon the recommendations. One of the reasons this is such a rare event is...

Just off the press, UK Prime Minister Gordon Brown has warned about the critical juncture of the economy and has warned about spreading the propaganda of a recovery. http://finance.yahoo.......

I don't know if anyone read the two posts I made on Monday about healthcare and HMOs, but they were lost when the site was hacked since I did not have a backup that recent. Anyway, in cas...

That's right, I said free. I'll even pay for shipping. All you have to do is help yourself. Okay, so what does that mean?

I've been working feverishly trying to complete my healthcare book. It's been a very difficult challenge juggling this project off-and-on for three years.

To those of you who say it's impossible to time or forecast the market; to those of you who keep wasting your time reading and watching the clowns positioned as so-called "experts" by the me...

Despite a big boost in shares in after hours trading, Wednesday's (disappointing) earnings for the online auctioneer represent a continuing trend that will not be broken anytime soon. Yes, t...

Today after the bell, Intel's only major competitor AMD reported disappointing earnings, missing by a large mark. This confirms what I discussed in the recent report released to newsletter subscribers...

I ran across this ridiculous headline on Yahoo! Finance (which is nothing more than the CNBC of the Internet) and I wanted to make a few comments.

An article from the Huffington Post today claims that Ford is "secretly" in talks to sell Volvo. First, let me say that this is another example of the media trying to create the perceptio...

The following report was released on June 10th as a follow-up to subscribers to the June newsletter.

ATTENTION TRADERS: Options go on sale next week! Starting June 15, Bernie Schaeffer is releasing 10 hot trades targeting gains of +100% or more. And each trade will close by June 19. 5 Days 10 HO......

I ran across an interesting announcement that bodes well for Fidelity and KKR. But I’m willing to bet it will be a bad deal for unsuspecting Fidelity investors. Kolberg Krav...

Early last year, I made a prediction that seemed obvious, given what I knew about the banking system and the fate of the stock market. I predicted there would be thousands of hedge funds shutting down...

Just a note about my postings. Some of you may be wondering why I have been making so many posts about the media, while ignoring the market and economy. The reason is two-fold. First of all, u...

In the recent past, I have cautioned investors against becoming prey to the vultures seeking to exploit your desperation, panic, fear and in some cases, ignorance of what the future of the capital mar...

Many of you who have followed me and read my most recent books (The Wall Street Investment Bible/2009 and America’s Financial Apocalypse/2006 & 2007) know that I feel the SEC is beyond...

America’s Financial Apocalypse How to Profit from the Next Great Depression (also attached as a PDF below) Part I: America’...

I'm getting quite bored watching the latest economic headlines surface. Bored you say? Yes BORED.

The economy is bad and getting worse. And it certainly isn't going to improve by much for a long time. Sure, the government will fool many with it's bogus data. But at the end of the day, millions wil...

Printing more money won't solve America’s problems; quite the opposite. It's going to damage the economy further. And these effects will be lasting. You will see them soon. At the very least, we...

I haven't made any comments about these so-called stress tests for the banks because it was obvious (to me anyway) it was just the latest PR scam devised by Larry Summers (carried out by his puppet, G...

Last week I released a piece that no other (qualified) financial professional was willing to expose because (in my opinion) they don’t want the masses to know how event-driven media-hyped tradin...

It's been a while since I made any posts about the market because there hasn't been much to discuss. A few weeks ago, I mentioned that the 8200 level was fairly significant and represented a pivo......

I wanted to discuss this whole swine flu hype that’s been blown out of proportion to illustrate how the media creates illusions from what would seem to be valid information. This also relates to...

It’s a bit funny to see that the SIRI stock pumpers are still at it, despite facing nothing but absolute humiliation after making ridiculous claims and clinging onto their delusions of grandeur...

The news of Andrew Cuomo's letter to Congress revealing that former Treasury Secretary Paulson threatened to fire Bank of America's CEO Ken Lewis and oust the board if they tried to block the Mer...

Fact #5. Most of the Lost Jobs Will Not Return What no one seems to understand is the fact that these job losses are not temporary. Most of them simply aren’t coming back. I’ll guarantee...

In the previous part of this article we saw how what Buffett invests in doesn’t matter to you. Let’s look at an example how the media uses the Buffett name to make money. I’d like to...

I decided to check out a couple of these so-called tea parties so I could confirm what I already knew. Let me just say this. I was disgusted by the naive nature of those in attendence...

You might recall a recent article I wrote called "Madoff in Perspective" where I point out that the real Ponzi scheme is being ignored - that orchestrated by the financial industry. I also make...

WASHINGTON (Reuters) - More U.S. chief executives got pay raises than had their pay cut in 2008, a year when billions in taxpayer dollars went to prop up struggling companies and millions of workers...

I failed to post anything about the market rally on this site (since it's still not 100% up and running). But I did make a couple of brief posts elsewhere a couple of days ago. Basically wha...

It seems as if many have been fooled by those supporting the banks. The general argument that has been made is that mark-to-market accounting has been largely responsible for the banking mess since it...

The stock market (the DJIA) is now very close to fair value from a long-term perspective (if that even means anything to an individual investor, which it may not). Those who read America’s Finan...

Posting When It Matters I want to thank those of you who've patiently waited during my apparent hiatus. I certainly wasn't on vacation. I don't take vacations. As I've said in the past, I'm not one ....

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse. The Jewish Mafia REFUSED to publish this landmark book because it...

Despite the strong closing bounce off the new intraday low of around 7400 reached on Friday, it’s likely the Dow has further downside. These lows may not occur for another 12-18 months.

This is the first time I’ve written anything about the Yahoo-Microsoft deal because I typically don’t allow myself to get distracted by noise. In fact, I’ve been receiving numerous e...

Blind Man’s Bluff Most of us have played Blind Man’s Bluff as children. It’s such a popular game among kids that several versions now exist. In case you don’t remember, here&r...

Bailout or Not. Depression is Upon Us McCain, along with Paulson, Bernanke, Bush and others are using scare tactics hoping to rush the approval of this historic banking bailout plan. Threats of a &ld...

Searching for Sanity Wall Street’s business model is broken. The high stakes game of Russian roulette which Wall Street never seemed to lose, is taking them down one by one. Commercial banks ar...

Bank of America’s buyout of Merrill Lynch seemed laughable to me - that is until I realized the full picture. With a $50 billion all-stock deal valued at $29 per share, at first glance...

Although not yet official, the verdict is on the way. Bear Stearns led the death march a few months ago. Now, Lehman’s bankruptcy filing signals the halfway mark of what will end up being the de...

I Repeat… I continue to be amazed by so many out there, from the pundits with their agendas to the so-called experts who zoom in on every grain of short-term optimism with an electron microsco...

Now we come to the Fannie/Freddie bailout. This is certainly a true bailout; not because taxpayers are on the hook for potentially $5.3 trillion, but because there was a moral hazard established once...