Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 3)

Continuing from PART 2

Myths about Gold Preached by Gold Charlatans

As I previously discussed, I was very bullish on gold in the past. However, I never positioned it as an investment in the same manner as equities or bonds because there is no credible way to value gold other than by the market approach. And if you think the market approach is valid, keep in mind it’s similar to the approach used to value real estate.

Moreov er, the higher gold rises in price, the riskier it becomes for new purchases because pricing over $1000 will not persist indefinitely. This is a fact.

er, the higher gold rises in price, the riskier it becomes for new purchases because pricing over $1000 will not persist indefinitely. This is a fact.

But Marc Faber has guaranteed that gold will never again decline below $1000. This should convince you that he is a complete clown.

One of the main selling points used by gold bugs to convince sheep to jump onto the gold rush band wagon is to point out that the U.S. is experiencing massive inflation that will soon morph into hyperinflation.

jump onto the gold rush band wagon is to point out that the U.S. is experiencing massive inflation that will soon morph into hyperinflation.

Of course, neither of these claims is true. But that doesn’t really matter to them. The only thing they are concerned about is creating panic and positioning gold as your savior.

In order to validate their wild claims, gold pumpers often point to wild claims and exaggerations published by John Williams. According to gold bugs, the U.S. has been experiencing massive inflation for several years, but the data is being suppressed by Washington. Again, this is not true. While inflation has certainly been higher than reported by Washington, it has not been “massive.”

Due to his extremist views, Williams has become central figure in the gold bug network. The problem is that Williams’ views are largely misguided as I have previously shown.

Due to his extremist views, Williams has become central figure in the gold bug network. The problem is that Williams’ views are largely misguided as I have previously shown.

I myself detailed how Washington manipulates economic data in America’s Financial Apocalypse.

As far as I know, the chapter devoted to this topic was the first comprehensive.jpg) publication on economic trickery by Washington. Yet, it is Williams who receives credit from the media for exposing economic trickery by Washington because the media would never air someone credible. Doing so would add validity to the argument. The key is to get some lunatic to make exaggerated claims. This will please the gold dealers who pay for ads, while not upsetting Washington since the individual has no credibility. This is how the game works.

publication on economic trickery by Washington. Yet, it is Williams who receives credit from the media for exposing economic trickery by Washington because the media would never air someone credible. Doing so would add validity to the argument. The key is to get some lunatic to make exaggerated claims. This will please the gold dealers who pay for ads, while not upsetting Washington since the individual has no credibility. This is how the game works.

The point I’m trying to make is that I understand both the means and extent by which Washington manipulates economic data. But the fact is that the U.S. is not experiencing “massive” inflation at the present time for other reasons which will be explained later in this article.

Exaggerated claims made by Williams and other salesmen d.png) emonstrate the commonly used tactic of taking something that is valid and blowing it out of proportion in order to support your agendas.

emonstrate the commonly used tactic of taking something that is valid and blowing it out of proportion in order to support your agendas.

This approach is used by Alex Jones, Peter Schiff, Kevin Trudeau, Robert Kiyosaki, infomercial scam artists, and so on. You get the point.

The tactic is often very effective when used on the average person because they do not recognize the need to verify the precise details of these claims. And even if they did, many of them lack the ability sift through the dust and find the real truth.

The tactic is often very effective when used on the average person because they do not recognize the need to verify the precise details of these claims. And even if they did, many of them lack the ability sift through the dust and find the real truth.

When trying to convince their audience that gold protects against inflation, one of the most ridiculous arguments made by gold bugs is the following…

“In 1860, an ounce of gold bought you a suit, etc...the same holds today.”

Accepting this statement as fact is presumed to provide sufficient evidence that gold protects against inflation. This type of simpleton argument appeals to unsophisticated investors lacking the ability to analyze the statement, pick it apart and reveal its inherent weakness.

It is also one example of many one-liners used by these charlatans. On the surface these one-liners seem to make sense, but each is riddled with flaws once you examine the details more closely. Since most gold bugs aren’t particularly sophisticated or experienced in topics related to investment management, valuation and risk, the one-liner marketing pitch serves its purpose well.

For instance, a reasonably intelligent person would ask what the price of a suit has to do with the ability of gold to retain its value. They might also ask the following questions:

Does the cost of suits increase or decrease over time?

Where is the empirical evidence supporting their assertion?

In the U.S., the cost of clothing has declined greatly in past decades. This is a fact (I have the data somewhere in our enormous research database).

We must also ask what kind of suit they are talking about. Was it of the same quality? Where is the documentation to confirm this?

Why not use other items? Why is it always a suit you hear about? Isn’t that odd?

And by the way, where did these individuals get their historical pricing data for suits? I would like to see it.

These types of “common sense” arguments are frequently stated to reinforce the so-called diminishing purchasing power of the dollar over time while highlighting gold’s ability to protect against inflation. The problem is these claims are largely untrue.

Regardless, the types of arguments used are always very simple to grasp so that even the biggest sheep will be lured because sheep don’t bother to examine the details of anything. In fact, most sheep are not capable of critical thinking, which largely accounts for their designation as sheep.

to grasp so that even the biggest sheep will be lured because sheep don’t bother to examine the details of anything. In fact, most sheep are not capable of critical thinking, which largely accounts for their designation as sheep.

When laying out their misguided and inaccurate arguments related to gold and inflation, gold bugs fail to mention that inflation is a natural phenomenon in the economy due to the fact that the supply end of the curve always leads the demand end.

As the dollar has lost its purchasing power, wages have increased through time. While wages may not have increased to sufficiently counter the effects of inflation, this is more of an issue of the inequities created through decades of misaligned (and in some cases criminally motivated) legislature passed by Washington, rather than the direct consequence of the dollar’s buying power. For instance, would you rather have the capital appreciation in gold from the past decade, or the compensation increase over in CEOs? I think you get the point.

Gold Charlatans Think the U.S. is Similar to Zimbabwe

By now, I’m sure you recognize the most common scare tactic used by gold charlatans. They talk about “imminent hyperinflation in the U.S., which would result in a worthless dollar, similar to what happened to Zimbabwe. Sometimes they even mention the ridiculous suit analogy as a corollary to this argument.

When comparing the fate of the U.S. dollar with the Zimbabwean currency, it appears as if it makes no difference to these charlatans that the U.S. is home to:

1) the world’s largest economy

2) one of the most highly advanced technological powerhouses in the world

3) the world’s R&D capital

4) one of the world’s highest living standards

5) the most powerful military with which to use if creditors want loans to be repaid.

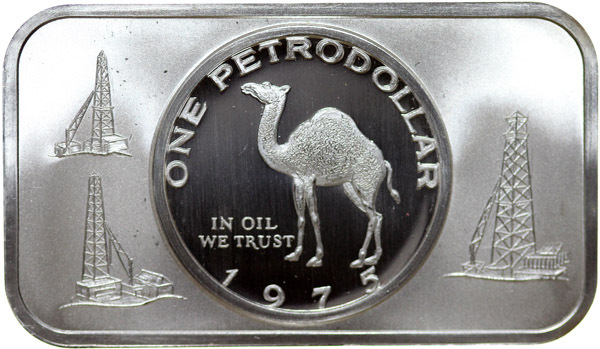

Most important of course is the fact that the dollar is linked to commodities. But you won’t ever hear these guys mention this because it would spoil their party.

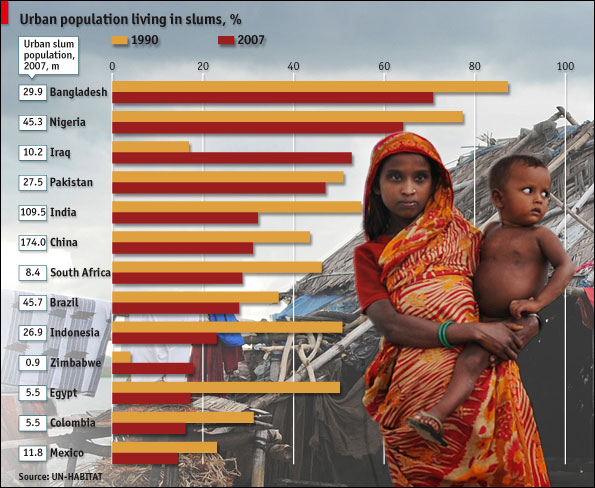

In contrast, Zimbabwe has been one of the world’s most impoverished nations, with a very long period of economic, political and social disarray. Similar to many African nations, Zimbabwe has a relatively ineffective and inadequate educational system, and is by no means an R&D powerhouse.

a very long period of economic, political and social disarray. Similar to many African nations, Zimbabwe has a relatively ineffective and inadequate educational system, and is by no means an R&D powerhouse.

Zimbabwe continues to suffer severe and permanent consequences of a long and brutal period of apartheid. It is has also been subjected to numerous sanctions from the U.S. and E.U.

Even prior to economic sanctions, the Zimbabwean economy has been miserable for a very long time, with living standards in the bottom quintile of the world in part due to the extortion by officials, and so on.

Even prior to economic sanctions, the Zimbabwean economy has been miserable for a very long time, with living standards in the bottom quintile of the world in part due to the extortion by officials, and so on.

Finally, Zimbabwe lacks the key relationship that has positioned the U.S. dollar as the world’s reserve currency; the dollar-oil link, often referred to as the petrodollar.

At the end of the day, national currencies are a direct reflection of the corresponding nation’s economic potential, the strength of its capital markets, economic and political stability and other factors.

Although the U.S. has lost a good deal of momentum relative to past decades, the fact is that it still scores very high in each of these categories. In contrast, Zimbabwe scores very low in the same categories. Thus, it should be obvious that anyone who would compare the United States to Zimbabwe should either have their head examined or else be labeled as a con artist.

Now ask yourself who has compared the state of the U.S. with that of Zimbabwe and you will begin to realize what kind of clowns, idiots and nut jobs you are dealing with.

Now ask yourself who has compared the state of the U.S. with that of Zimbabwe and you will begin to realize what kind of clowns, idiots and nut jobs you are dealing with.

You know who they are because they are the same individuals positioned as “experts” by the media. As the facts show, virtually every gold bug has made claims that the U.S. will share the same fate as Zimbabwe. What does that tell you??

Over the past couple of years these charlatans have been flooding every media portal with yet another lie in order to get sheep to buy gold. They have been claiming that China is selling U.S. Treasury securities. However, once again I dispelled this “myth” in convincing fashion.

Don't you find it VERY ODD that I am perhaps the ONLY PERSON in the world who continues to set the record straight regarding the myths being spread about gold??

Certainly, debunking some of the claims made by gold deale.png) rs requires a fairly advanced understanding of investments. But most of these myths can be debunked by amateurs who challenge what they are fed.

rs requires a fairly advanced understanding of investments. But most of these myths can be debunked by amateurs who challenge what they are fed.

Similar to my precious articles setting the record straight on gold, not one of the gold dealers responded because they understand that when you are outmanned, the best strategy is strategic retreat.

By pretending that they did not see the article, they will not feel obliged to respond because they know their double-talk BS won’t work on me. They know I will make them look even more ridiculous and deceitful than they already are.

Folks, this emphasizes why I have been banned throughout the Internet. This is ABSOLUTELY CRITICAL to understand. These gold charlatans do not want Main Street to have access to a voice of reason; someone with no bias and with no financial stake in any way in gold; someone who previously recommended gold.

Gold is NOT Money; It’s Jewelry

Perhaps the most frequent statement made by gold bugs is that “gold is money.”

Whenever I hear or read that statement, the first thing I do is laugh. Next, I ask myself whether the person making that claim is really that naïve or just a typical gold bug charlatan looking to heard more sheep into the slaughterhouse.

myself whether the person making that claim is really that naïve or just a typical gold bug charlatan looking to heard more sheep into the slaughterhouse.

Let me make something crystal clear so that even the most unsophisticated gold bugs will be able to understand it…

Gold is NOT money. This is a statement of fact.

One could have argued that gold was money decades ago when we were on the gold standard, but that was then and this is now. Today no nation is on the gold standard.

I repeat…Gold is NOT money. Gold is jewelry. The problem is that no one has to have jewelry. It’s a luxury. But we do need oil. Crude oil is not only used for fuel, it is also used for its chemical properties in a very large range of industries.

We also need many other commodities. Moreover, unlike crude oil, copper or silver which are depleting assets used in numerous industries, gold has very little industrial use so it is never depleted.

So if gold is not money, what is?

You know what the answer is to this.

Money is defined by the U.S. government.

The same applies to the U.K. or any other nation. In the United States, the government has decided that money or legal tender is the U.S. dollar. Anyone who is unable to understand or accept this is likely to be mentally deficient or brainwashed beyond help.

You can go back 200 years ago and talk about how gold and silver coinages were used as legal tender. But unless you have a time machine, that argument isn’t going to do you one bit of good because we aren’t living in the Colonial era.

Those who might try to transpose historic periods onto the present are likely to have some serious mental issues. We are dealing with the present day. And at present, the U.S. government says the U.S. dollar is the only legal currency to be used in the U.S. And I don’t expect this to change in my lifetime, at minimum.

That is not to say that I prefer a fiat currency system because I certainly do not, as it only benefits the money changers at the expense of everyone else. But the fact is that this is the system we have. And it is the same system we will have (at least in the U.S.) for the foreseeable future.

In fact, I would imagine that the day a first- or second-world nation decided to use gold as its currency would be the day hell freezes over. There are many reasons for this which I cannot get into here. In short, it is extremely difficult for nations to deviate from the global economic, trade and currency standards engineered and administrated by the Global Establishment.

Furthermore, holders of U.S. dollars remain in the very enviable position because it is the only currency in the world that is linked to commodities. This makes the U.S. dollar a very safe currency; the safest in the world in fact. This is not just my opinion. It is also the opinion of virtually all credible institutional investors and everyone else who truly understands how things work. This is specifically why investors rush to buy U.S. Treasury securities and other dollar-denominated assets every time global panic surfaces.

If you have not realized this by now, you have not been paying attention. And you never read America’s Financial Apocalypse because I discussed this point in detail.

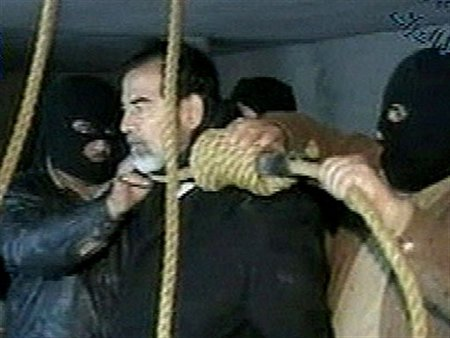

In this book I also discussed that the reason why Washington has been trying to come up with an excuse to invade Iran is due to the fact that it has been selling its oil for other currencies on its own oil exchange. This is precise what Saddam Hussein did in 2000.

come up with an excuse to invade Iran is due to the fact that it has been selling its oil for other currencies on its own oil exchange. This is precise what Saddam Hussein did in 2000.

Accordingly, I feel it is important for you to ask yourself why you have never heard any of the gold bugs touted by the media as experts discuss the dollar-oil/commodities link.

The fact is that if you are not willing or able to dissect and verify the details of everything you are told you are going to be subjected to the endless scams and lies preached by snake oil salesmen, whose only objective is to line their pockets with your money. In short, unless you are both willing and able to see through the smoke and mirrors, you will most likely be victimized for the rest of your life.

The fact is that if you are not willing or able to dissect and verify the details of everything you are told you are going to be subjected to the endless scams and lies preached by snake oil salesmen, whose only objective is to line their pockets with your money. In short, unless you are both willing and able to see through the smoke and mirrors, you will most likely be victimized for the rest of your life.

I’m here to help guide you towards the path of truth and reason. And I hope you will continue to follow my lead because I will guarantee you I’m right. But if you still have your doubts, I’ll let my track record speak for me.

As well, keep in mind that I actually stand to lose income by exposing the realities about gold and everything else that all other disseminate myths about in order to line their pockets. Figure it out.

Read PART 4.