Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Opening Statement from the February 2022 Intelligent Investor (part 1)

Opening Statement from the February 2022 Intelligent Investor (part 1)

Originally published on February 9, 2022

Overview

The big story since the release of the January issue is that the Fed is considering raising interest rates sooner than previously expected and by a greater amount due to inflation concerns. This boost in rate hike estimates represents the most rapid change in estimates in years. Investors reacted by selling both stocks and bonds over the course of several days.

Perhaps the second biggest story has been the tremendous surge in crude oil prices. The rally in crude should not come as a total surprise given continued progress being made in the global recovery along with Russia’s military buildup in Ukraine. There is even talk of a Russian-led invasion of Ukraine in coming weeks. If this happens, crude oil is likely to soar well past $100. Apparently, traders are factoring in this possibility along with the collapse in diesel inventories and the recent winter storm in Texas. Most recently crude sold off as tensions in Russia have eased for now.

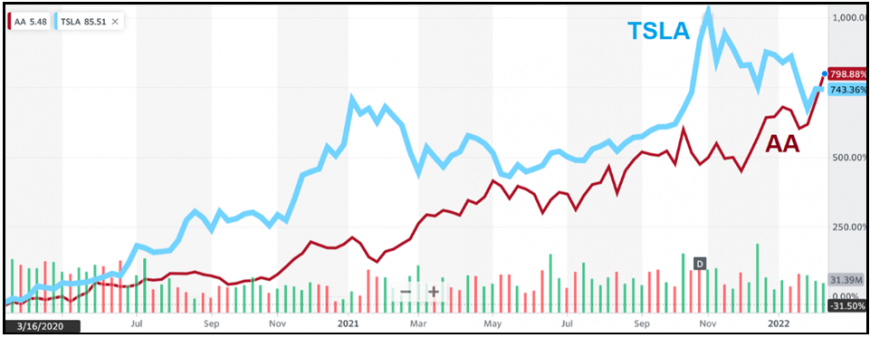

Importance of Diversification

Recent selloffs in several high-tech leaders serves as a reminder of the importance of diversification. And this is why we have a decent variety of different types of stocks on the recommended list. In particular, what was once a laggard and what many deem as a boring stock, AA has delivered blockbuster returns over the past two years. You’re not going to hear anything about AA in the media, but the fact is that it has now outperformed TSLA over the past 23 months with returns of nearly 800%...