Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Get Ready for the Earnings Meltdown

I’m not talking about the banks or even the retailers. We all know they will continue to slide. I’m talking about everything else.

With no real median wage growth since 1999, and soaring inflation for gas, food and healthcare, it’s obvious consumers have had much less to spend. Not only has that hurt savings rates (including retirement contributions) but it’s also affected consumer spending. So don’t expect things to get better by Fall. In fact, I’m expecting the earnings meltdown to begin for much of the remaining sectors in the S&P 500.

You Can Run but You Can’t Hide

Standard & Poor’s earnings estimates for Q2, Q3, and Q4 of 2008 are -11%, 40%, and 60% respectively.

Remember, this the same S&P that rated the mortgage junk AAA. It will also be the same S&P that will end up issuing drastic revisions in earnings once the bottom falls out. But that won’t help investors after the fact.

You have to realize what lies ahead and react accordingly. With about 65% of the S&P 500 companies having reported Q2 earnings, the results have not been so bad, with about 70% having beat the 2007 mark. In fact, as the pundits love pointing out, “if you remove the problem child – the financials, S&P earnings have increased by 10%.”

"Regardless of the estimates or hype, a double-digit gain from non-financials is impressive — in any economy," said Howard Silverblatt, S&P's senior index analyst.

Sure it’s impressive when the Fed has been in a printing frenzy.

Well guess what? You can’t remove the financials from S&P earnings. With about 92 financials in this index of 500, we are talking about 16.7%. Also consider that earnings were aggressively revised downward so as not to disappoint.

More important, how well do you think earnings will be down the road with the heart of the economy – the financial system - collapsing?

Add to that soaring inflation and you will soon see earnings collapse as consumers fall flat on their face. Even the correction in oil prices won’t save the ship. Oil would have to fall to $80 or lower and stay low for many months. Even if it did, it would take 6 months to a year before the effects would be seen in the economy.

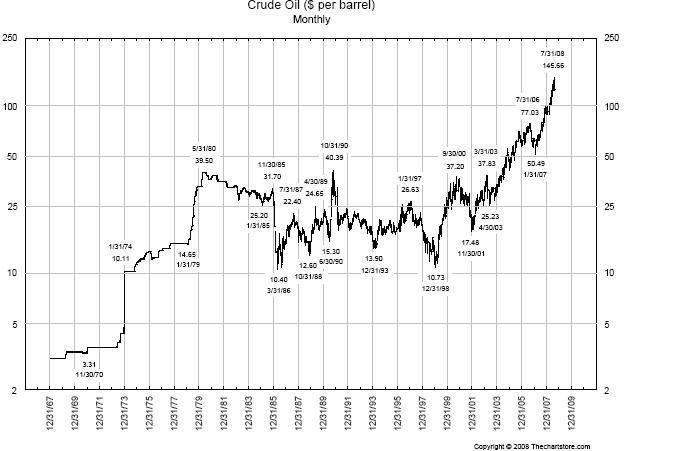

So how far will oil correct? Well as you may recall, in a previous article, I mentioned the possibility for a 30% to 40% correction in oil when it was around $140 (see “Using Oil to Beat Inflation”). Thus far, my forecasts have not changed except I am now leaning towards the high end of this estimate, placing the correction to around $100. At least in America’s case, that is really the one trillion dollar question.

Could oil correct down to $80? Yes. But I would not expect to stay there for long. Remember this is just a short-term trend. As you can see from the chart, the long term trend remains strongly intact. Therefore, this correction will present a buying opportunity in the near future. Consequently, it is due to these huge swings in volatility that I recommend non-active traders to consider investing in oil trusts since they deliver nice double-digit dividends.

Distance Yourself from the Herd

Please do not forget that Washington through its rebate checks, and the Fed through its endless printing of money, have made their most desperate attempts to delay a recession. While they have failed in my opinion, the real severity is coming soon.

Make no mistake about it; S&P earnings estimates for Q4 won’t even come close to estimates. By the time Washington reports the required (and laughable) “two consecutive quarters of negative GDP” it uses to officially acknowledge a recession, it will be too late for investors who followed this herd mentality.

Continued problems in the credit markets combined inflation will create a drag on earnings. This will accelerate corporate bankruptcies by late 2008, only to soar thereafter. Perhaps the only force that will help earnings will also be the force that ultimately takes them down - inflation. You can’t inflate your way out of a recession, nor can you consume your way out of one either. And Washington is about to learn this first hand.

Sure, it’s possible that we will see the market rally over the next couple of months. If so, you would be wise to sell. More aggressive traders might consider shorting it entirely once it tops out based on the 1-year resistance trend line.

It’s also possible that the Dow will break down below the 10,731 lows it made a couple of weeks ago. Only time will tell. It all depends on when the consumers fall and companies start to revise downward. Throughout this difficult period, you would be wise to keep in mind where the slope of the DJIA lies. Eventually, the Dow will follow this slope. It’s just that simple. Don’t try to make it more difficult than it really is.

.jpg)

Now that you know the other side of the picture, you should be better positioned to navigate the market through 2008. As I have been advising for several months, you should sell on rallies and only buy after sell-offs if you’re a really good trader because the market is trending downward.

The few investors who had the luck or insight to liquidate their portfolios many months ago might be better off waiting for more clarity. The correction in oil will most likely continue, but that will represent a buying opportunity. I will continue to buy more oil and healthcare. Everything else in the U.S. market is a lost cause for now.

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse.

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribesmen (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.jpg)

.png)

.png)

.png)

.png)