Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Opening Statement from the October 2020 CCPM Forecaster

Opening Statement from the October 2020 CCPM Forecaster

Originally published on October 4, 2020 (pre-market release)

Economy

The slow pace of improvements in the U.S. labor market serves as one of many indicators confirming our long-held view that recovery from the COVID-induced global recession will be long and difficult.

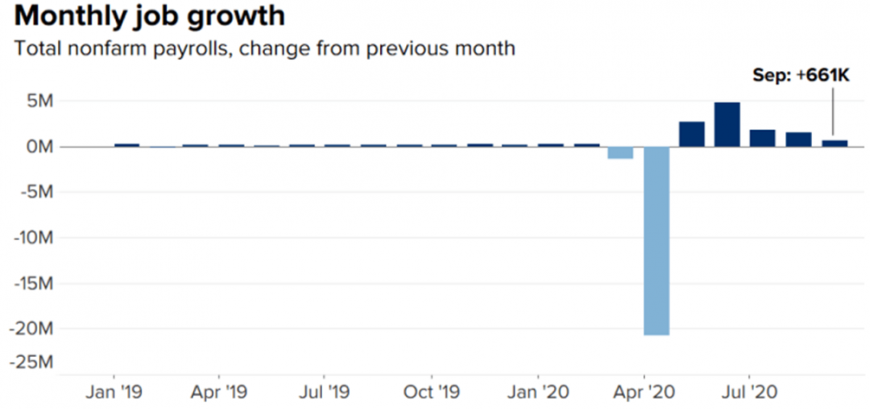

As further evidence of this claim, on October 2 the Bureau of Labor Statistics reported an increase of only 661,000 jobs in September, which was less that the 800,000 estimate.

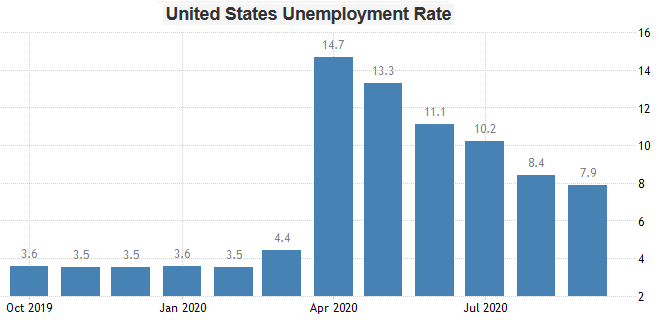

Although the unemployment rate fell from 8.5% the previous month to 7.9%, much of the decline was due to jobless workers no longer being counted.

The September jobs data also revealed a sizable increase in long-term unemployment (a duration of 27 weeks or more) of 781,000, raising the total to 2.4 million. Moreover, 7.3 million workers have now been without a job for at least 15 weeks.

Although the economy added 4.8 million jobs in June, 1.8 million in July and 1.5 million in August, the U.S. economy is still down 10.7 million jobs from where it was in February, before the impact of the pandemic.

We reiterate our view that up to one-third of the lost jobs will never return. As well, we believe the economic recovery is going to take much longer than most people realize.

Most of the long-term unemployed continue to receive extended unemployment benefits which will run out by the end of 2020. However, another round of economic stimulus is all but certain.

On September 30, the Bureau of Economic Analysis released its final estimate of GDP for 2Q at 31.4%, for the largest contraction on record, down from 31.7% in the previous month’s estimate. Although the expected rebound in 3Q GDP to (current estimates range between 22% and 25%) will officially end the recession, there is no way...