Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Gold Has NO Intrinsic Value. This is a FACT Based on Finance and Economics.

Over the years I have been exposing the countless lies and myths spread about gold and silver by gold dealers, paid off precious metals promoters and delusional minions who have been hoodwinked by the precious metals pumping crime syndicate.

See the article headlines at the end for more articles, audios and videos on gold and gold con artists.

Here’s a tiny list of examples:

Top 20 Gimmicks and Lies of Gold Charlatans - 100 pg e-book

Understanding Manipulation of Gold by the Media

Understanding the Proper Use of Gold and Silver

Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 1)

Gold Charlatans Strike it Rich While their Sheep Get Fleeced (Part 1)

Dow-Gold Ratio Scam and Pricing of Gold in Foreign Currencies Scam

The California Gold Rush of the Twenty-First Century

Dismantling John Williams' Hyperinflation Predictions

Rather than jumping on the gold-pumping band wagon, a move which would have easily landed me a 7-figure annual income for merely playing cheerleader (i.e. making up wild stories about gold, the dollar, the stock market and the economy) I did something no one else in the professional investment world opted for. I stuck with the truth. And I put my ass on the line while sacrificing big time money in order to try and help the average Joe.

I’ve committed a great deal of time and effort towards exposing the gold pumping crime syndicate. I considered it a public service. Little did I know I would be alone in these efforts.

Even today, some eight years after I began exposing this filthy syndicate, I've received virtually no support for these efforts. At best, I’ll occasionally get a lengthy email sent to me by my colleagues that details how a person admits they were fooled by the gang of gold pumping shysters, and now they're down by $400,000 as a result of having no exit strategy in their gold position. Inevitably these individuals seek me out hoping to get advice on what to do.

Never mind that they still haven’t figured out that the key to investment success isn’t to jump onto the latest fad but instead to commit yourself to a source of knowledge and expertise so that you can learn from unbiased experts instead of being hoodwinked into scams.

Never mind these individuals never even bothered to sign up as a member of the website so they could learn more; so they could begin the process of being transformed from a sheep into a sound investor.

Never mind any of this common sense. They all want advice from me. And they want it for free.

It doesn't work that way. Anyone offering anything for free is either scamming you or else setting you up to be scammed by others who are paying them. Think how ad-based content works. Think the media. Think Facebook. Think free emails. Do you get the point? See Free versus Paid Content.

Never mind the fact that these individuals ultimately fueled the gold pumping crime syndicate in a variety of ways, from generating thousands of dollars in commissions buying precious metals (some of this money was funneled back into the media in the form of ads and paid hacks).

Never mind they rewarded the gold-pumping con artists at their own expense thereby making the scam a successful business venture for the perpetrators.

The victims of the gold-pumping scam never stopped to think that after all I’ve done to help people avoid being scammed, the least they could do would be to become a member of AVA Investment Analytics so they could support my efforts to help the average Joe.

No, certainly not. Instead, they probably donated money to some of these guys when they went on their ebegging campaigns.

At the very least they supported the gold-pumping syndicate of scammers by contributing to views which boosted advertisement revenues, promoted these cons as legitimate and credible. At worst they bought gold and silver from them and their buddies.

Rewarding criminals while punishing the police is the best way to ensure scams continue.

These individuals wanted a quick fix to a problem that was ultimately conjured up in their own mind. If you fell for the gold-pumping scam it was because you allowed it to happen.

So if you fell for this scam you need to do some real soul searching.

You need to find out why you couldn't see what was so obvious to others.

You need to clear your mind.

You need to learn how to think critically and logically.

Most of all you need to learn how to spot con artists.

These are among the many topics we address as part of the content outside of the economic and investment research we publish.

Rather than listen to reason, the victims of the scam constantly repeated the lines fed to them by their cult leaders.

Rather than question agendas and motives, the victims of the scam embraced a kind of fanatical religion preached by the various precious metals ministers.

It didn't matter how obvious it was to others that they were lying or how little credibility they had (think Lindsey Williams and Mike Maloney) or how wrong they've been over and over (think Peter Schiff and Jim Rogers). Precious metals cult members believed every word from every precious metals pumper's mouth. They fell for the scam hook, line and sinker.

That’s the type of ignorance that’s truly a curse because it's extremely difficult to remedy.

For some, it's impossible to resolve. These are the types of folks destined to fail.

God help these people.

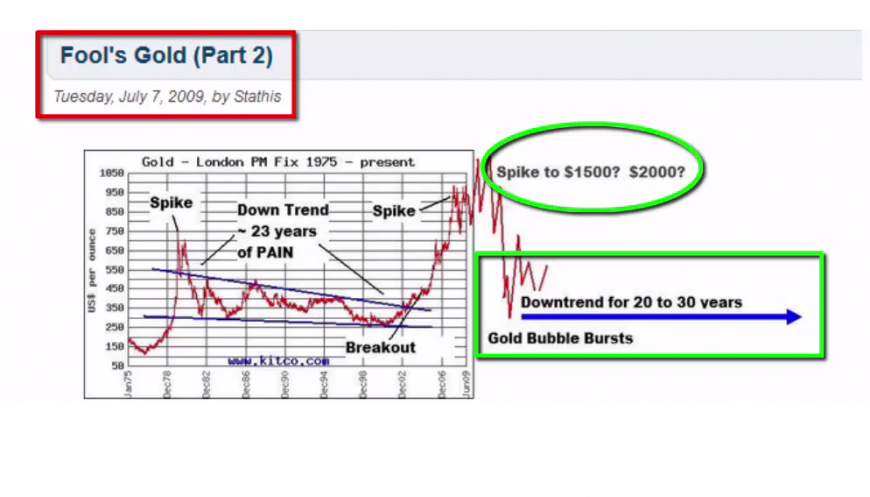

My mission to expose the liars, their lies and to explain how this syndicate operated in recruiting new cult members while keeping current members from breaking free from the web of deceit began once I spotted a bubble forming in the precious metals market around late-2010. Remember, I first warned that the bubble would come in July 2009 in Fool's Gold. I even predicted the peak price at $2000.

I even published an announcement in fall of 2011 that I was selling the last of my silver coins when the price was just under $50 per ounce.

All along I knew what the result would be. And I realized it wasn’t going to be too pretty for most of the individuals who had been suckered by the precious metals propaganda that was spreading like a California wildfire unless they happened to be a dealer of precious metals or one of the thousands of paid pumpers.

You see, precious metals dealers and promoters win the game regardless where the price of gold and silver head. I tried to emphasize that point over and over years ago, but the gold bugs just couldn’t see the light. This is typical when you’ve become inducted into a cult.

These same cult members failed to ask themselves if it made sense that the same people who were telling them that fiat currencies were going to be worthless were willing to accept this fiat currency for gold and silver.

And let’s not forget, these are the same characters who have been claiming physical gold and silver have been in short supply for years. Yet, they’ve been anxious to sell you their physical gold and silver for your “worthless” fiat currency. Truly amazing, huh?

Although gold had not yet entered a bubble at the time, all of the essential elements required to create a bubble were already present throughout the internet and broadcast media. So I knew it was coming. It was all so obvious to me. So I felt it was my duty to do something before it was too late.

I began my crusade to warn the public about an upcoming bubble in precious metals in July 2009. I began these warnings with an article I wrote called Fool’s Gold which was published in three parts.

In this now famous article, Fool’s Gold, I not only discussed the manipulation by gold dealers, I also explained the proper use of gold. I also warned gold bugs of the need to have an exit strategy instead of holding it forever.

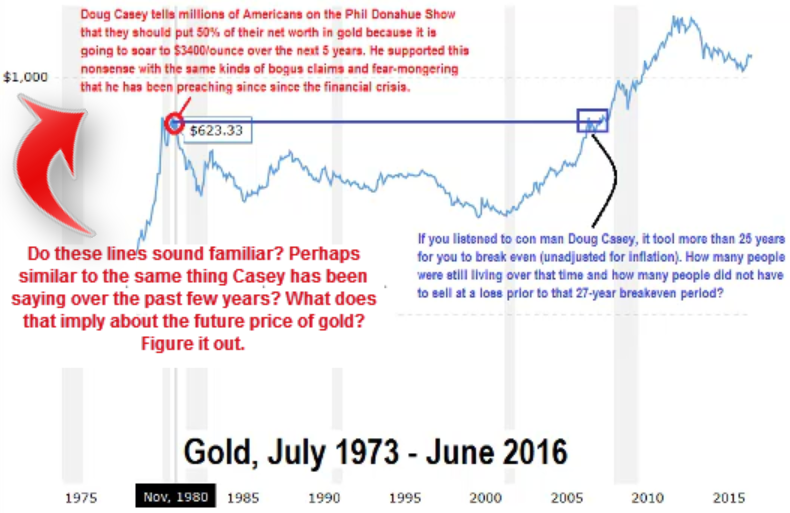

I also laid out a rough multi-decade forecast for gold which included a peak from between $1500 to $2000 per ounce. Thereafter, I predicted the gold bubble would burst and gold would remain in a downward trend for many years, ultimately declining to $300 to $400 where it would remain for many years. See Fool’s Gold (part 2).

As it turned out, thus far I have been 100% correct about gold and silver.

I actually hold the leading investment forecasting track record in the world since 2006; a claim backed by $1 million. See here.

Some of my track record is here (other portions of my investment research track record have either not been released in order to protect the value of our research forecasts or we have not had a chance to post updates since our focus is providing world-class research, not marketing).

In fact, I even predicted the bullish retracement in gold and silver that began in early 2016. Subscribers to the CCPM Forecaster know this all too well.

Now if you're still waiting for gold to fall to $300 to $400 (I later increased this range to $500) just give it some time.

Remember that this forecast was very rough and was made BEFORE quantitative easing was launched. Finally, it was a forecast for 20 to 30 years from 2009.

While the precious metals propaganda army was proclaiming this rally in 2016 as the beginning of a new bull market in gold and silver, I specially stated that the upside would last one or two years and would represent a nice selling opportunity because it would only turn out to be a retracement rally from within a long-term bear market as opposed to the beginning of a new bull market in gold.

A few years before this rally, I had even mentioned the possibility that gold and silver could enter a one or two-year bull market that would not last and would not push gold prices beyond $1500. I added that this rally would most likely suck many poorly informed individuals into it as they thought it was the start of a new bull market.

As is always the case, whenever someone writes or says something that isn’t so positive about gold or silver, the precious metals cult comes out of the wood works reiterating numerous myths and lies they have been told by their gold pumping ring leaders.

After a while of hearing and reading the typical nonsense these cult members rattle off, you can predict just about everything they will say in advance. It's almost like a script. It can be a bit scary to come across some of these individuals because you start to wonder what's going on in their heads.

At the same time the gold bugs assume individuals who have made disparaging remarks about gold and silver must have an axe to grind or are “bashers.” Without looking into the person’s background or examining their track record, they rattle off their predictable nonsense, like a script.

Of course, if these cult members were aware of the critical need to look into the background and track record of everyone who opens their mouth, and if they were capable of accurately assessing track records, they wouldn’t be stuck holding gold and silver with huge losses.

As an example, I do not know of a single person in the precious metals pumping syndicate that has a good track record or even has real credibility.

Can you name a single individual from that gang that has a good track record of forecasts?

I can't. In fact, every single one of those slime balls have served as excellent contrarian indicators.

Can you name a single gold-pumping ring leader who has real credibility?

I can't.

Is there a single one of these gold shysters that doesn't have a shady past?

So far I haven't found a single one with a clean slate.

And I’ve investigated just about every single one of these hucksters.

My former clients know I was recommending gold stocks beginning in late-2001 because I sensed the beginning of a bull market in gold; but not due to economic fundamentals.

The fact is that there are no real fundamentals underlying gold and silver pricing other than supply and demand.

The main reason why gold and silver began their bull run during that time was due to the dotcom bubble collapse as well as the impact of 9-11 on the capital markets combined with many years of suppressed gold and silver pricing.

Two years before the financial crisis began I recommended buying gold and silver (America's Financial Apocalypse, 2006) as one component of what end up being extraordinarily lucrative investment strategy. 1

The following image was taken from America's Financial Apocalypse (Extended Version, 2006).

But rather than advising people to buy physical gold and silver unlike what all precious metals dealers were doing, I recommended buying the gold and silver ETFs because they were associated with much lower transaction costs.

I also preferred ETFs because they were liquid, unlike physical gold and silver.

Finally, I discussed the need to have an exit strategy in gold and silver as well as the need to trade the ETFs in order to reduce risk by exploiting the price volatility. I reiterated this message in my 2009 article Fool's Gold, as well as in many other articles, videos and audios.

The following image was taken from America's Financial Apocalypse (Extended Version, 2006).

What can I say?

Shoot me for acting honestly and trying to educate everyday investors while helping them avoid being ripped off by gold dealers.

Incidentally, I think it's important to note that these recommendations for handling precious metals are standard protocol for every legitimate financial professional.

The problem was that there were no legitimate financial professionals pitching gold and silver. There still aren’t any today. And I doubt tomorrow will be any different given the nature of that very shady industry.

At best you had a couple of boiler room stock brokers, at least one of which had previously been accused of fraud by securities industry regulators.

I find it ironic that the same man who was accused of fraudulent marketing practices in the 1990s was pulling the same kinds of stunts in a few years ago, but this time for some reason he got away with it.

Many other figure head precious metals dealers and pumpers came from shady pasts as well.

If the small handful of gold pumpers who came from the financial industry had any real knowledge about finance, economics, valuations and how the capital markets operate, they sure didn’t express this knowledge.

All they were doing was pitching fear and greed while playing on the emotions of confused and worried individuals who simply wanted to do the right thing for their future.

By definition, this was a huge con. It was and remains illegal. That means everyone involved could face legal actions, but only if enough people complain to the right authorities.

Now you know why these gold pumpers are desperate to keep the cult members deluded.

In short, they want the cult members who have lost huge amounts of money (and also stand to lose much more in the future) to keep the hope alive.

But of course they're also hoping to recruit new members in order to rack up more commissions and pump the price of gold and silver up. The problem is that many of these people who were burned as well as younger potential new recruits have moved into cryptocurrencies.

Yes of course the cryptocurrency market is another scam run by the same gang that's behind the precious metals industry, Wall Street, the banks, the Federal Reserve, the media and many other industries.

By now you know who I'm talking about. If you want to get scammed, this group will make sure it happens.

I would advise everyone to avoid anything being run by Jews unless you have someone by your side who really knows what's going on.

And if you don't understand the tribal nature of Jews you probably don't realize how and why they take over entire industries while everyone on the outside gets hosed.

Many of these cult members will die still believing the lies they swallowed from the precious metals pumpers.

Others will gradually fade out of the cult and back into reality.

Either scenario will be effective because each one will reduce the odds that a sufficient number of victims will file a complaints with various state attorneys general and federal trade commission. Most of these victims don't even know who to file complaints with.

Continuation of the propaganda will also act to help ensure various statutes of limitations have come and passed so long as the precious metals cult leaders are able to keep hope alive.

One of the biggest precious metals pumping cult leaders has the kind of resume you'd expect from this gang of charlatans. He was a high school dropout. And his only work experience prior to selling gold and silver was as a car audio salesman.

After selling car radios, he became one of the hard-sell pitchmen associated with the Robert Kiyosaki’s “cash flow” and “wealth generator” seminar scams.

Perhaps you've heard about these scams on infomercials if you happen to watch Jerry Springer or Cheaters reruns at 2am or 3am? They're always set up at hotels near the airport so they can make a fast getaway after they've conned the suckers who show up for the "free" event.

'Rich Dad' author's seminars cost thousands, but not everyone gets rich

'Rich Dad Poor Dad' Robert Kiyosaki Exposed - Part 1 of 3 Investigative Report

Anyway, I could go on and on about this epic scam which is not likely to even be recorded in history books since after all, the media was a prime player. And I’m not just talking about the so-called “alternative media.” While frauds like Alex Jones, Jeff Rense and thousands of other liars and con artists consider “alternative media” talking heads were pushing all kinds of crazy conspiracies and fronting wild stories about the economy and such, the so-called mainstream media was also involved in the gold pumping scam.

I’ll just mention a few names to fresh your memory. Peter Schiff, Glenn Beck, Ron Paul, and every single conservative talking head on the radio such as Mark Levine, Jerry Doyle, etc. Think about it.

[1].jpg)

By the way, if anyone would like to write a book about this gold pumping scam using my content (all articles, videos and audios since 2009) contact us. This is a story that needs to be told in a book.

1 This investment strategy included moving to cash as well as other options depending on different levels of risk. It was detailed in America’s Financial Apocalypse (2006). This book was banned by all publishers and all media because they did not want Americans to know the full reality of the various subjects I detailed, from America’s free trade disaster, political correctness, illegal immigration problem, to the real truth about Social Security, the healthcare crisis, the underfunded pension problem, the wealth and income disparity, the for profit college scam, massive Wall Street fraud and much more. This book would end up being the most detailed and accurate predictor of the financial crisis as well as a crystal ball into many other issues.