Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Opening Statement from the May 2018 Intelligent Investor (Part 1: Securities Analysis)

Opening Statement from the May 2018 Intelligent Investor (Part 1: Securities Analysis)

Originally published on May 10, 2018 (pre-market release)

Big Picture

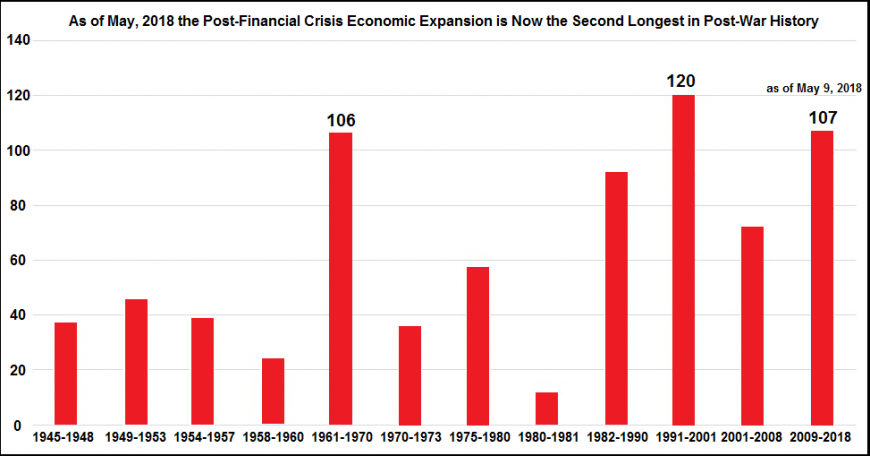

We have previously discussed that the current bull market is the second longest in the post-war period. Up until recently the current economic expansion had been the third-longest since the post-war period. This expansion is now in line with the bull market. The month of May marks the 107th month of the post-crisis expansion. As a result, the current economic expansion is now the second-longest since the post-war period, having recently surpassed the expansion between 1961 through 1970 (106 months).

The expansion between 1991 through 2000 remains on the record books as the longest since the post-war period at 120 months. Will we surpass this expansion? If so, it would most likely extend the current bull market into the longest since the post-war period.

Based on our current assessment, we believe...

Whether or not or to what extent this possible record-setting economic expansion and bull market are based on fully valid fundamentals is a completely different topic of discussion. Our objective is to understand the most important variables, estimate relative probabilities of material events and to navigate the capital markets based on our assessment of these variables and estimates of relative probabilities rather than to focus on contemplating if or why something does or does not make sense. Individuals who focus on the latter pose a severe threat to the objectives of investors because they are likely to be inundated with the trivial dogma and nonsense.

Individuals who focus on apocalyptic themes or rant about the Federal Reserve will never make money as investors. But this is not their goal. These individuals seek to exploit others by pitching dogmas and virtually impossible narratives. And they rely on the media to provide them with sufficient exposure with which to lure their prey. They are charlatans disguised as financial experts. And they are provided with constant media exposure with which to leverage into book and newsletter sales and anything else that ties into their fear mongering rants.

Unfortunately there are numerous charlatans who steer investors into this destructive mindset. These investors are first transformed into cult members. Eventually, the cult members become addicted to the narratives they have swallowed from their cult leaders. They eat, sleep and dream about the dogma preached by these cult leaders rather than seeking out credible investment analysts who are able to deliver unbiased, actionable, prudent and profitable investment insights and strategies.

Ultimately, as you can imagine, many of these cult members miss out on tremendous gains in the capital markets. Others lose nearly everything after having been fooled by the ever so predictable sales pitches from the mouths of these slick con artists. Ultimately, these investors become victims.

I have been exposing media charlatans and their numerous scams for many years now hoping to remind investors what their focus should be and who they should avoid. Sadly, these efforts have largely fallen on deaf ears, for it is always much easier to fool someone than it is to convince them they have been fooled. This is especially true today with the internet as the prime source of information for many people.

The internet is completely filled with disinformation. It’s even worse than broadcast and print media. As a result, it is virtually impossible for most people to use the internet as a source of information on complex and subjective topics such as economics and investments. Yet, this is precisely where most people get their economic and investment insights. And they actually believe they know what’s going on when very few individuals actually do. Social media has made the internet exponentially more dangerous.