Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Another Security from the Intelligent Investor Soars

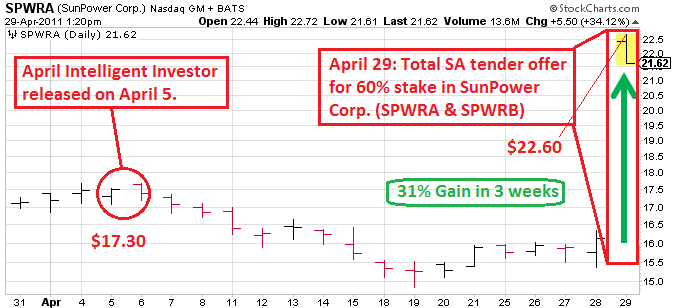

On April 5 before the U.S. market opened, we released the monthly issue of the Intelligent Investor; about 70 pages discussing everything from domestic and global economics, to currency, gold, silver, oil, natural gas, emerging markets and U.S. market forecasts.

We also discussed the Intelligent Investor recommended securities, providing trading guidance, as always.

While we have liked the solar space for some time now that valuations have come down to earth, we have not explicitly added any solar securities to the recommended list because they currently do not fit our requirements for investment.

However, on page 15 of the Global Economics section, Mike discusses the potential upside to solar stocks.

Let’s have a look.

“Meanwhile, I see continued trading opportunities and potential intermediate-term upside to select solar stocks such as SunPower (SPWRA) and LDK Solar (LDK) with a preference of the former (last two charts).

While both stocks are very attractively valued, the big question is the long-term growth. Thus, speculation of shifting energy policy across the globe as the result of Japan’s nuclear disaster could help fill in uncertainties regarding the growth of the solar sector.”

SPWRA opened at $17.30 on April 5. After trading down by about 10% over the following two weeks, shares soared today after management announced a tender offer by Total SA (Europe’s third largest E&P oil company) to purchase up to 60% of the outstanding shares of the company, which would value shares at about $23.65.

Based on the April 5 opening price of $17.30 and the current intraday high of $22.60, that led to more than 30% gains for subscribers who entered a position and patiently waited over the next three weeks.

(click on image for larger view)

This marks the second buyout of a security just days to weeks after it was discussed in the Intelligent Investor that soared to more than 30% gains.

In addition, just a few weeks prior to its 70% breakout, Mike highlighted another stock as part of his recommended securities.

Note that these spectacular calls are on top of the remarkable performance of the entire list of recommended securities.

Furthermore, these calls were for stock purchases, not options, making them even more impressive.

You should also note that within a couple of weeks after the first issue of Dividend Gems was published, one of the 17 recommended securities was also bought out, leading to similar gains.

We certainly do not want subscribers who are looking fast profits, as this approach most often leads to demise. Instead, we focus our publications on active management, providing readers with the necessary guidance and analysis so they can manage their investments, whether or not they choose to invest in our recommended securities.

We accomplish this by providing market forecasting and economic analysis sections.

Finally, these publications teach investors numerous skills focused on asset and risk management, valuation and other aspects of the investment process leading to the advancement of each reader’s investment IQ.

There are not many professionals who possess such a comprehensive understanding of the investment process than Mike Stathis. This is specifically why several financial advisers, hedge fund and mutual fund managers, as well as Wall Street analysts subscribe to the Intelligent Investor.

His track record is becoming legendary whether we are talking about his market forecasts, real estate forecasts, precious metals and currency forecasts, or securities selections and trading guidance.

The May issue of the Intelligent Investor is scheduled for release early next week. We advise those who have not yet subscribed to this comprehensive investment research publication to do so now.

More information about the Intelligent Investor can be found here.