Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

We Sold CenturyLink BEFORE It Collapsed

We also have some additional news to report for Dividend Gems subscribers.

On February 14, 2013, the same day Berkshire Hathaway announced a huge payday for Dividend Gems subscribers with a buyout offer for Heinz (HNZ) for more than $72/share, Warren Buffett Follows Our Lead on Heinz ...

...shares of another one of our recommended securities were downgraded after management cut the dividend by 26%.

The stock, CenturyLink (CTL) collapsed by more than 22% from the previous day’s close of $41.69 before settling at $32.27.

Fortunately, we consistently recommended selling shares for several months due to valuation concerns.

You see, there are times to buy, times to sell and times to hold stocks.

Even dividend securities must be actively managed.

That’s really the whole point of Dividend Gems.

For instance, we demonstrated the importance of knowing when to buy and when to hold even the most stable blue chip dividend securities McDonalds with a piece we wrote last year. See here.

Did You Own The BEST PERFORMING Stock In 2011? WE DID

Sophisticated investors understand the power of active management.

Those who advocate a buy-and-hold approach are either ignorant or lack the skills required to actively manage their investments.

For instance, listen to what John Bogle (founder of Vanguard) has to say about market timing. Investors Are Ignoring the REAL Risks to the Market: John Bogle

According to Mr. Buy-and-Hold, you can’t time the market; it’s impossible to forecast the stock market.

He claims he doesn’t know anyone who can time the market and he doesn’t even know anyone who knows anyone who can time the market.

Apparently, Bogle only knows mutual fund managers…guys who take a buy-and-hold approach.

Greetings, Mr. Bogle. Let me introduce myself to you. Check my market forecasting track record so I can watch you eat your words.

Market Guidance: Past, Present And Future

A Lesson In Market Forecasting

Where Is The Stock Market Headed?

We Pin-Pointed The Past Two Market Tops And Bottoms

We Predicted The Market Correction AGAIN

Mike Stathis' Near-Perfect Market Forecasting Record

Since The Market Lows, Only One Man Continues To Shine

AVAIA Market Forecast And Recommendations SPOT ON, AGAIN

We Predicted The Market Selloff Yet Again

Clearly, Bogle is not a skilled investor. He is a businessman. And his entire business plan revolves around convincing everyone that you can't beat the market indices. If you believe that myth, you will buy index funds and pay him fees.

The problem is that, when when confront with evidence that the markets can be timed, guys like Bogle will never admit it because it would destroy his entire index fund argument.

Well, I have some news for Bogle. Index funds are a huge rip off. The fees should be no more than 0.1% because they aren’t doing anything other than automated updates to the indexes.

Now that ETFs have entered the picture, Bogle is quick to trash them because they are resulting in huge outflows of cash from his index funds. Certainly some of his criticisms of ETFs are legit.

For instance, when he speaks of leveraged ETFs, inverse ETFs and even sector ETFs. These types of ETFs are NOT for retail investors in my opinion. However, you won't hear Bogle address the issue of ETF index funds because they come with lower fees than his Vanguard index funds.

I’ll get back to Bogle another time.

Bogle is right about one thing though. The trading game is speculation and for almost everyone, eventually leads to net losses. The reason for this is because of the approach traders use. In short, they have their heads up their asses.

If however, you utilize fundamentals and technicals, stick with the same basket of stocks to trade and utilize smart position entry, exit and hedging strategies, trading not only can work, it WILL work. And it will smash the indices. The problem is that this system I have described is very difficult to master.

I provide a good deal of the results of this approach in Dividend Gems.

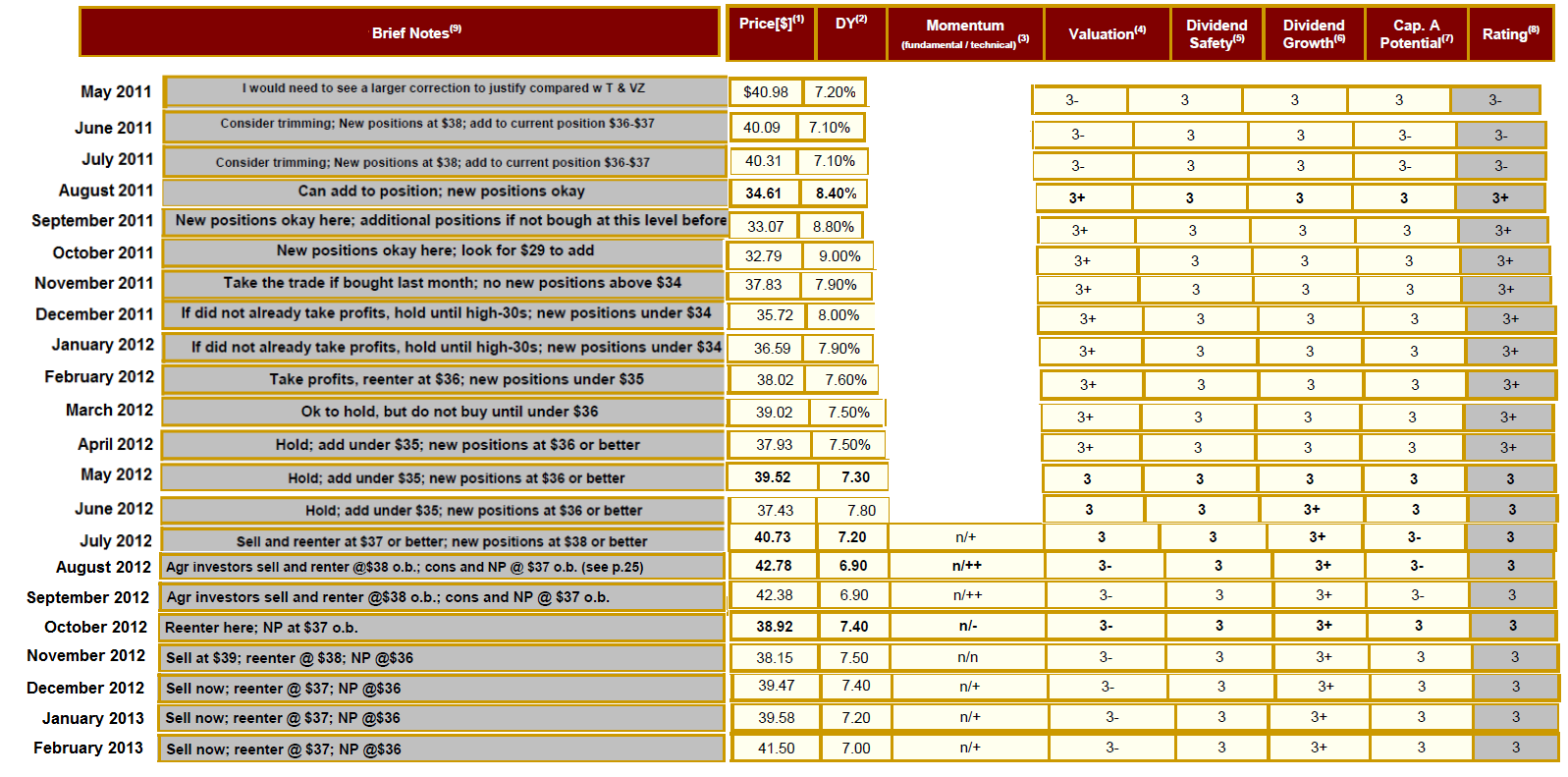

Below we show our trading guidance from the Brief Notes section of the Dividend Gems Recommended List. This section presents an abbreviated analysis and guidance for each security.

[In order to get a good idea how accurate our trading guidance has been, you’re going to need to follow the data closely as you look at the price chart over the relevant time period.]

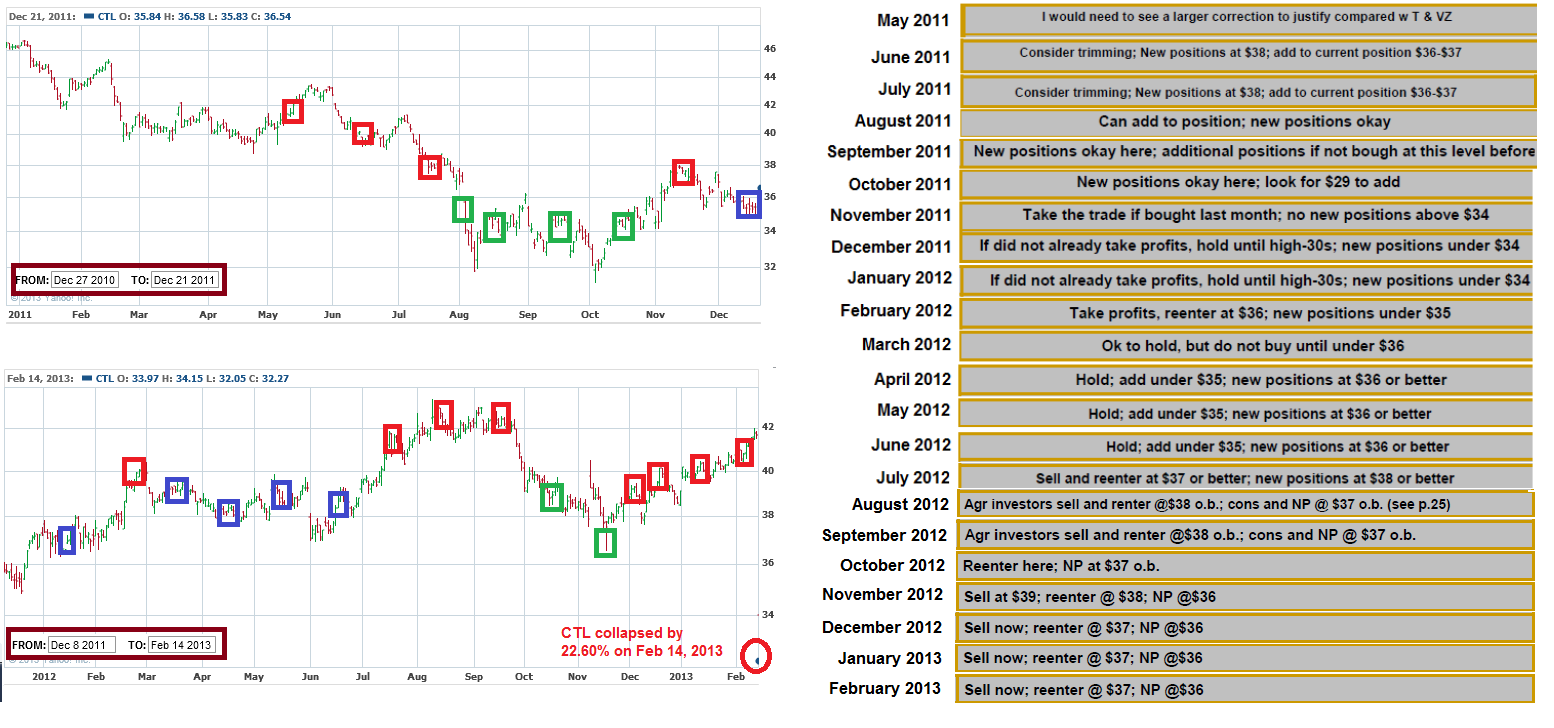

As you can see, we generally advised investors to buy low and sell high.

To the left you can see the recommendations provided under the Brief Notes section for each month (some monthly issues contain detailed analysis for selected securities).

The Price column shows the trading price at the time that monthly issue was released. The other columns show the various ratings for CTL at the time of release each month as well.

As you can see, between November 2012 and February 2013, we issued several monthly warnings to sell CTL prior to yesterday’s collapse. And although we advised a reentry at $37 or better, subscribers know that due to the material events, that this entry price is no longer valid. We will provide forward guidance for CTL in the March issue.

Notice that CTL has our lowest allowable valuation rating of 3-, as well as a fairly low potential for capital appreciation.

In the next data series, you can trace the monthly recommendations with the price chart.

Again, as you can see we generally advised investors to buy low (green boxes) and sell high (red boxes).

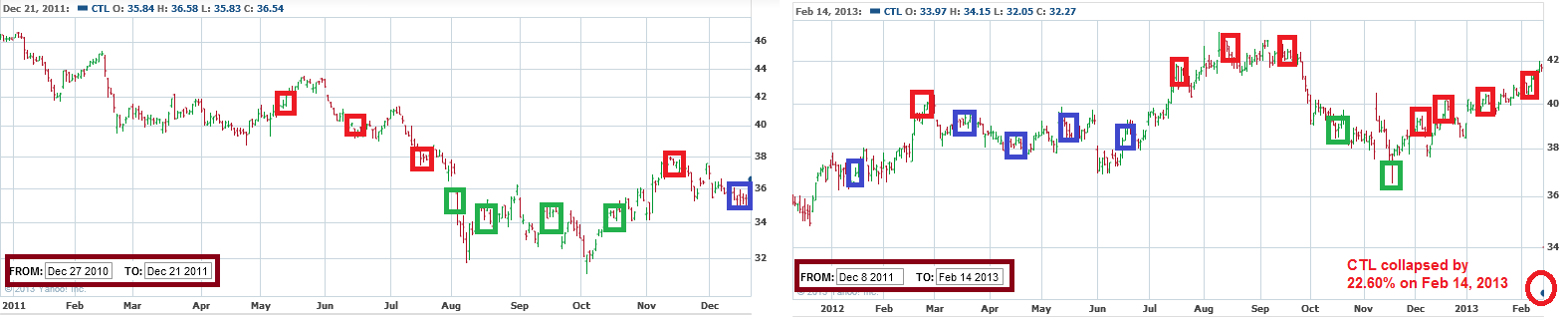

Finally, we have added data from the first and second figure while splitting up the price chart so that each month is more visible.

In the final figure we have attached the charts from the previous figure to make it easier to see that we were advising to buy low and sell high.

This is just one example of the kind of trading guidance we provide in Dividend Gems.

We did not cherry pick this example. We only used it to show you how you can make money and avoid losses by actively managing your securities.

You should note that once the dividend was cut and the stock collapsed, several Wall Street analysts downgraded it and lowered the price target…gee guys thanks a lot. This is typical.

Analysts rarely get you out in time. In contrast, we downgraded CTL nearly 4 months ago and advised subscribers to sell since November. And because our reentry price never materialized, all subscribers who followed our guidance would have been out of CTL before it collapsed yesterday.

As you might have imagined, Jim Cramer was ranting and raving about CTL just two weeks ago…just another nail in this clown’s coffin.

This just goes to show that you cannot buy and hold. You must always actively manage your portfolio. If you don’t, you’re going to get blasted. I’ll guarantee it.

You will get the same result if you listen to Jim Cramer, the rest of the clowns and idiots on CNBC, FBN, Bloomberg, read the Wall Street Journal, Barron’s and other financial media. That’s just the way it is.

For a limited time, we are offering a special promotion for Dividend Gems.

See here for more information. Special Dividend Gems Promotion